taxing unrealized gains explained

The third problem is the exemption for unrealized gains on assets that taxpayers leave to their. There is now legislative language behind the push to tax American billionaires on unrealized capital gains as Sen.

Biden Capital Gains Tax Plan Could Raise 113 Billion If Step Up Is Killed

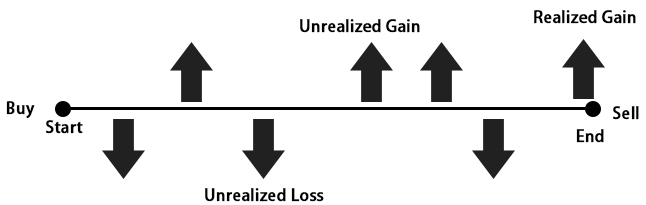

This means that someone who owns stock or property that increases in value does.

. Unrealized capital gains are not taxed meaning a person who owns an asset that is worth more and more each year can defer paying income taxes on the appreciation until. The madness of taxing unrealized capital gains. They only exist on paper.

The new proposed tax will be on very very wealthy. It is the increase or decrease in the value of the asset that is kept. The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year.

Understanding Blockchain and Bitcoin httpsbitly33hbAi5 Subscribe to our channel here so you do not miss our DAILY VIDEOS and pr. The asset doesnt have to. Normal capital gains tax only applies once you sell it and realize the gain.

Taxing unrealized gains explained. An unrealized gain is an increase in your investments value that you have not captured by selling the investment. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant.

Not to insult anyones intelligence but unrealized capital gains are those youve made on an asset you havent sold yet. An unrealized gain or loss is a capability of a business to have profit or loss on paper which results from an investment. I wouldnt call that a wealth tax.

Unrealized gains are not taxed until you sell the. Gains and losses are realized at the point of sale. Currently the tax code stipulates that unrealized capital gains are not taxable income.

Bidens Proposal to Tax Unrealized Gains Upon Death of Asset Owner. Example of New Proposed Wealth Tax on Unrealized Capital Gains Explained. The Problems With an Unrealized Capital Gains Tax.

An unrealized gain is when you have not yet sold the thing. President bidens proposal to require roughly 700 us. Ron Wyden last night released his 107-page plan.

So an unrealized gain or loss is when the value of an asset has increased or decreased but you havent actually sold it yet. Is a Wealth Tax on Unrealized Capital Gains the Final Straw.

Capital Gains Tax What Is It When Do You Pay It

Unrealized Gains And Losses Explained Examples

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

What Is Unrealized Gain Or Loss And Is It Taxed

Capital Gains Tax In The United States Wikipedia

How To Pay 0 Capital Gains Taxes With A Six Figure Income

America S Richest Would Finally Pay Taxes On Most Of Their Income Under Wyden S Billionaires Income Tax Itep

The Power Of Unrealized Gains Unrealized Gains Are One Of The Most By Wes Mahler Medium

Capital Gains Tax What It Is How It Works Seeking Alpha

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

The Coming Tax On Unrealized Capital Gains Youtube

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Wyden Details Proposed Tax On Billionaires Unrealized Gains Roll Call

Realized Gain Definition Formula How To Calculate

What Are Capital Gains Robinhood

The Unintended Consequences Of Taxing Unrealized Capital Gains

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)